The Definitive Guide for Mortgage Broker

Wiki Article

Facts About Mortgage Broker Association Revealed

Table of ContentsEverything about Broker Mortgage FeesLittle Known Facts About Mortgage Broker Assistant.The Ultimate Guide To Broker Mortgage RatesHow Mortgage Broker Assistant can Save You Time, Stress, and Money.Fascination About Mortgage Broker Vs Loan OfficerIndicators on Mortgage Broker Job Description You Should KnowOur Mortgage Broker Meaning IdeasMortgage Broker Vs Loan Officer - Questions

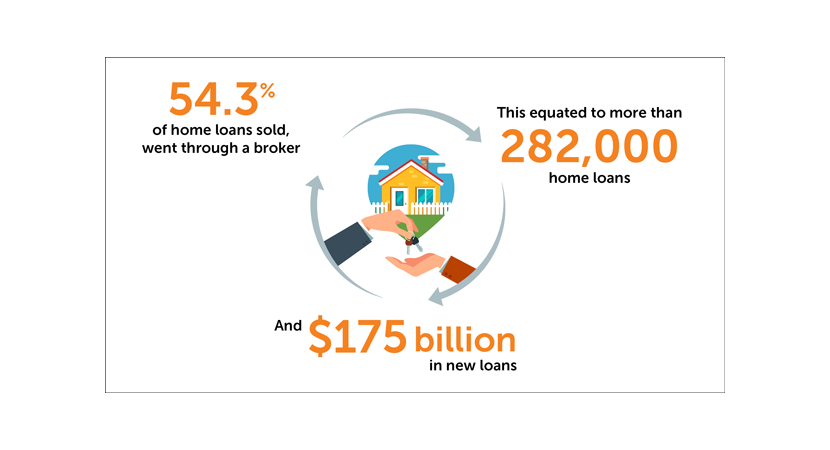

What Is a Mortgage Broker? The mortgage broker will certainly work with both events to get the individual approved for the funding.A home mortgage broker typically functions with lots of various lenders and can provide a range of car loan alternatives to the debtor they work with. The broker will collect details from the individual and also go to several loan providers in order to discover the ideal prospective lending for their customer.

The Best Strategy To Use For Mortgage Broker Association

The Base Line: Do I Required A Mortgage Broker? Functioning with a home loan broker can save the borrower time as well as effort throughout the application process, as well as potentially a lot of cash over the life of the lending. Additionally, some lending institutions function exclusively with home loan brokers, indicating that consumers would have accessibility to finances that would certainly otherwise not be available to them.It's important to examine all the fees, both those you could have to pay the broker, as well as any type of costs the broker can assist you prevent, when considering the decision to collaborate with a mortgage broker.

The Best Strategy To Use For Mortgage Broker Vs Loan Officer

You've possibly listened to the term "home loan broker" from your realty agent or pals that have actually purchased a home. What precisely is a home loan broker and also what does one do that's various from, claim, a financing officer at a bank? Geek, Pocketbook Overview to COVID-19Get solution to inquiries concerning your home loan, traveling, financial resources and also keeping your comfort.1. What is a home loan broker? A home loan broker functions as a middleman in between you and possible lending institutions. The broker's work is to contrast home mortgage loan providers in your place as well as discover rate of interest that fit your requirements - broker mortgage near me. Mortgage brokers have stables of lending institutions they work with, which can make your life simpler.

Some Ideas on Mortgage Broker You Need To Know

Just how does a home mortgage broker earn money? Home loan brokers are usually paid by lending institutions, in some cases by customers, yet, by regulation, never ever both. That law the Dodd-Frank Act Forbids mortgage brokers from charging concealed fees or basing their compensation on a customer's interest price. You can likewise pick to pay the mortgage broker on your own.What makes mortgage brokers different from loan policemans? Loan policemans are staff members of one lender that are paid set wages (plus rewards). Loan policemans can compose just the kinds of car loans their employer chooses to supply.

Broker Mortgage Near Me - Questions

Mortgage brokers might be able to provide debtors accessibility to a wide choice of funding types. You can conserve time by using a mortgage broker; it can take hrs to use for preapproval with various lenders, after that there's the back-and-forth interaction involved in underwriting the financing as well as ensuring the purchase stays on track.When selecting any type of lender whether via a broker or directly you'll desire to pay focus to lending institution costs." Then, take the Loan Price quote you get from each loan provider, position them side by side and also compare your rate of interest rate and also all of the charges as well as shutting expenses.

The smart Trick of Mortgage Broker Meaning That Nobody is Talking About

Exactly how do I select a mortgage broker? The finest way is to ask buddies and loved ones for recommendations, yet make sure they have actually used the broker as well as aren't simply dropping the name of a former university flatmate or a far-off acquaintance.

Mortgage Broker Can Be Fun For Anyone

Competition as well as residence costs will certainly affect exactly how much home loan brokers earn money. What's the distinction in between a mortgage broker and also a car loan policeman? Mortgage brokers will deal with lots of lending institutions to locate the very best lending for your situation. Loan police officers benefit one loan provider. Exactly how do I discover a home loan broker? The most effective way to discover a home mortgage broker is through references from family members, buddies and your property agent.

3 Simple Techniques For Broker Mortgage Meaning

Purchasing a new residence is just one of the most complicated occasions in an broker mortgage rates individual's life. Residence vary greatly in regards to design, features, institution district as well as, of course, the constantly important "location, place, area." The home mortgage application procedure is a complicated aspect of the homebuying process, specifically for those without past experience.

Can establish which issues could develop problems with one loan provider versus an additional. Why some purchasers prevent home loan brokers In some cases property buyers feel extra comfy going straight to a huge financial institution to protect their finance. Because case, buyers must at the very least speak to a broker in order to comprehend every one of their alternatives relating to the kind of financing and the readily available price.

Report this wiki page